Hang Seng China Depressed Economy Worries

The Hang Seng index in Hong Kong Stock Exchange closed down -43.17 points or -0.22 percent, to 19809.03 triggered investor caution amid fears the Chinese economy and a possible increase in US interest rates next month.

Fears of economic slowdown Tiongok appear with reduced investor enthusiasm on signs that China’s economic recovery has lost steam and as policy makers more cautious on stimulus for bad credit companies soared.

Pessimism has replaced optimism as the government has put the restructuring is not a stimulus or growth, at the center of policy-making.

Technically,

Resistance: 19900 19990 20100 High / Low: 19936/19706

Support: 19800 19710 19 620 Closed Price: 19 833

Comment: For intraday trades today suggest Buy at the level of 19 750; stop loss at the level of 19700; the target at the level of 20010.

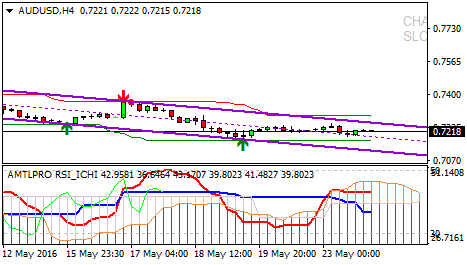

RBA Governor’s Speech Narrowing Aussie At 0.72

Aussie traded in a narrow range with the market focus is fixed on a speech by Governor Reserve Bank of Australia (RBA), Glenn Stevens, today.

This will be the first appearance of RBA Stevens since the RBA cut interest rates on 3 May.

Markets will scrutinize his speech related to the condition of inflation and weak domestic labor that can refer to continued interest rate cuts.

As the growing speculation Fed rate hike in the near future. Iron ore is the main commodity of Australia.

Technically,

Resistance: 0.7250 0.7300 0.7350 High / Low: 0.7258 / 0.7193

Support: 0.7200 0.7150 0.7100 Running Price: 0.7222

Comment: For intraday trade today suggest Buy at the level of 0.7170; stop loss at the level of 0.7135; targets 0.7268.

Crude Oil Prices Fell Slightly

Crude oil prices traded lower for manufacturers in Canada continue production after forest fires and Iran continue to increase exports.

The cold weather helped to control the flames in the oil sands in Canada and allows Suncor Energy Inc. and Syncrude Canada Ltd. to resume production activities.

“The news that Canada tried to resume production in Alberta and that Iran plans to export 2.2 million barrels of oil per day have hit the market yesterday,” said Gene McGillian, senior analyst at Tradition Energy, as quoted by Bloomberg.

Meanwhile in Iran, Managing Director of National Iranian Oil Co. Rokneddin Javadi said that Iran does not plan to join the efforts of the world’s oil producers to suspend production because they spur exports as sanctions against the country lifted. Iran will meet with other OPEC members at a summit next June 2nd.

Technically,

Resistance: 48.42 48.90 49.40 High / Low: 48.30 / 47.38

Support: 47.60 47.10 46.60 Running Price: 48.09

Comment: For intraday trade today suggest Sell 48.70; stop and reversal during a break above the 49.00; level targets at the level of 47.10 and target of reversal at the level of 49.90.